Andrew Hewison Studios

Managing Director

Only Fools Don’t Lease…

14 Jan 2014

Well, not quite but under the right circumstances the heading rings true…

My task this week is to peel back the complexity and highlight the areas you should focus on when deciding whether leasing your vehicle is financially beneficial.

When operating a vehicle under a lease arrangement with your employer, it is viewed as a ‘fringe benefit’.

What is a fringe benefit?

A fringe benefit is a non-cash benefit which is provided to an employee or an associate of the employee (such as a family member) in respect of the employee’s employment.

Paying Fringe Benefits Tax (FBT)

FBT is payable by employers and is assessed on the value of the fringe benefits provided to the employee. The benefit does not have to be provided directly by the employer in order for FBT to apply.

As FBT is paid by the employer, the fringe benefit is exempt income of the employee for income tax purposes. That is, it is not subject to income tax, however, in most cases the employer will pass on the FBT liability to the employee.

FBT is calculated at the top marginal tax rate of 46.5%.

Operation of a novated lease

A novated lease refers to an arrangement whereby all, or part of the lessee’s rights or obligations under the vehicle lease are taken over by an employer. The lessee is usually the employee but could be an associate of the employee, such as a spouse.

When is a novated lease a good idea?

This is where it gets a little tricky.

It depends on factors such as: income tax bracket, price of the car, purpose of the car (private or business), alternate finance options, terms of the lease including – lease period, interest rate and residual value of the vehicle.

There are two methods to calculate a lease – the statutory method or the operating cost (or log book) method. If the car is used for business purposes, the operating cost method should be used. In the examples below, I have used the statutory method.

As you will see below, simply speaking, under a lease arrangement the repayments are deducted from your pre-tax salary, therefore income tax is calculated from a lower income figure. That said, FBT is calculated at 46.5%, so if your tax rate is lower than 46.5%, the FBT may outweigh the income tax saving.

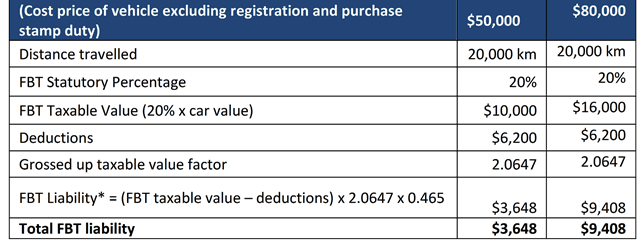

Calculating FBT

Using two vehicle purchase amounts in the table below, FBT is calculated using a fairly simple formula. It used to be that the statutory percentage reduced with the more kilometres travelled, but it is now a flat rate 20%.

FBT can be reduced by deducting the operating expenses of the vehicle. Some deductible expenses are:

– Fuel (est: $3,000 p.a)

– Servicing (est: $1,200 p.a)

– Registration (est: $600 p.a)

– Insurance (est: 1,100 p.a)

– Parts, and other expenses (est: $400 p.a)

Is there a benefit?

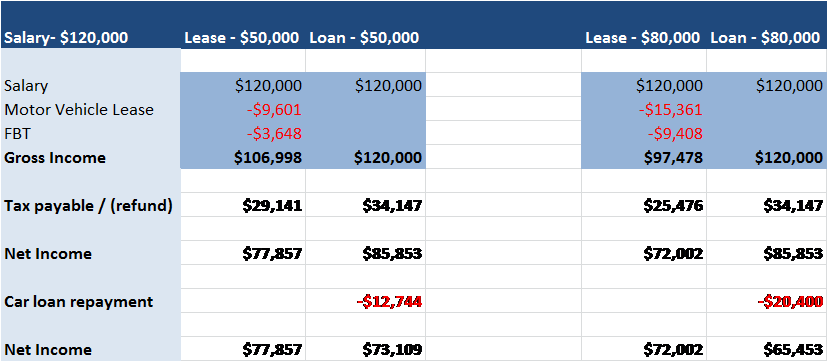

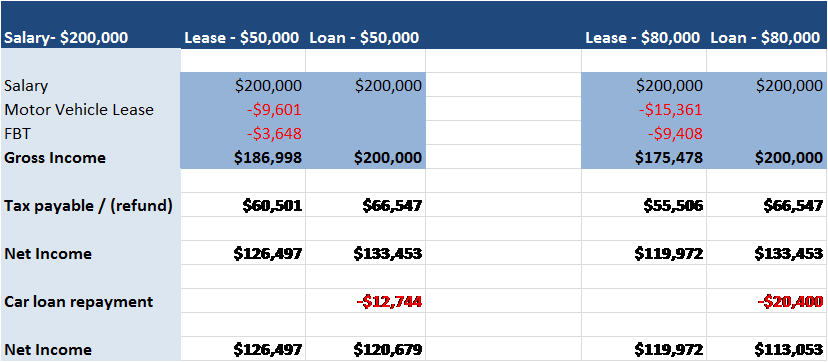

We now need to turn our attention to the income tax calculation. What benefit can be obtained from leasing a vehicle verses funding from our after tax income?

Assumptions:

– Lease term: 4 years

– Interest rate: 7%

– Residual: 40%

Summary

Lease verses a personal loan ($50,000)

The after tax benefit of leasing is $4,748* per annum.

Lease verses a personal loan ($80,000)

The after tax benefit of leasing is $6,549* per annum.

Lease verses a personal loan ($80,000)

The after tax benefit of leasing is $6,919* per annum.

*This expense is based on the following persona loan assumptions:

– Loan term: 5 years

– Interest rates: 10% per annum

– Residual: zero

What to take out of this

- The cheaper the car, the less FBT you will pay. The reverse is also true. Therefore, a more expensive car will reduce the effectiveness.

- Although it seems like leasing is more effective with a more expensive vehicle, this is because of the alternate cost of borrowing personally to fund the vehicle is extensive.

- Although the personal loan rate is higher, at the end of the repayment term, you would own the vehicle outright. At the end of the lease term you would still owe 40% of the vehicle value.

- If you can access debt via your home mortgage at lower interest rates, you may be better off. The challenge may be to gain access to the amount you want to buy that Ferrari!

Hewison Private Wealth can help you with financial planning – including advice around novated leases.

Hewison Private Wealth is a Melbourne based independent financial planning firm. Our financial advisers are highly qualified wealth managers and specialise in self managed super funds (SMSF), financial planning, retirement planning advice and investment portfolio management. If you would like to speak to a financial adviser on how you can secure your financial future please contact us 03 8548 4800, email info@hewison.com.au or visit www.hewison.com.auPlease note: The advice provided above is general information only and individuals should seek specialised advice from a qualified financial advisor. The views in this blog are those of the individual and may not represent the general opinion of the firm. Please contact Hewison Private Wealth for more information.